Key Takeaways

The latest U.S. tariff policy has taken this to a new level, with some very large reciprocal measures. These consist of a 125% increase on Chinese goods and temporary 10% tariffs on other imports. These policy changes represent the highest tariff rates in the U.S. since the early 20th century.

Industry-specific tariffs—such as the 25% steel and aluminum tariffs—are increasing production costs for manufacturers. At the same time, they’re creating new opportunities for reshoring and accelerating domestic supply chain development. Businesses need to consider the long-term sustainability of these changes.

The agricultural community can expect negative impacts such as diminished competitiveness of agricultural exports and increased costs of imported agricultural inputs. Farmers are shifting through finding alternative markets and relying on government support, but how long farmers will be able to sustain these options is unknown.

New higher tariffs are making inflation worse, having raised costs for Americans on imported goods and domestic goods equally. Low- and middle-income consumers are already reeling from elevated prices for essential goods. In turn, the Federal Reserve is starting to revisit monetary policies.

Retaliatory measures from U.S. trading partners, such as tariffs on U.S. exports, are further aggravating global trade dynamics. Businesses are looking at supply chain regionalization and more diversified sourcing strategies to work around these unknowns.

Though tariff-induced disruptions led many firms to innovate and diversify supply chains, critics worried about a long-term negative impact on U.S. global competitiveness. To be effective, long-term strategies should trade off economic growth for national security and other geopolitical ambitions.

We want to hear how the most recent U.S. Tariff policy has affected your sector of the economy. It has hit home everywhere — from manufacturers to farmers. By increasing or decreasing import taxes on certain products, the policy seeks to defend local industries from unfair competition and battle trade deficits.

These cumulative changes have upended supply chain strategies more than ever before. Businesses have a limited window to change sourcing and production strategies to mitigate rising costs. For consumers, the effect is most visible in increased prices of imported products, which shifts consumer purchasing behavior.

Small businesses and new exporters, in particular, are disproportionately affected as they wrestle with the rapidly changing climate around trade. Whether you’re a business or an individual, knowing how these tariffs affect you is key to making smart decisions in the weeks and months ahead.

Understanding the Latest U.S. Tariff Policy

With the latest U.S. tariffs policy, we are witnessing a radical change in our country’s trade policy, which includes significant tariff actions that impact almost all industries and trading partners. In April 2025, we passed these steps as part of a broader movement aimed at enhancing national security interests. This ambitious effort seeks to address both profound economic and geopolitical crises, having a tectonic effect on global trade patterns.

What are the key changes in the latest tariff policy?

The policy unveiled new reciprocal tariff actions against almost all trading partners. For instance, a 31% tariff was imposed on imports from South Africa starting April 2, 2025. On April 5, 2025, the federal government introduced a 10 percent blanket tariff on all imports, a move aimed at addressing a decades-long trade deficit amidst a national emergency. This tariff action is part of the broader tariffs policy designed to bolster economic security in the face of international challenges.

Certain products were specifically targeted, including a 25% tariff on imports of both aluminum and steel. In 2023, imports accounted for 44% of the aluminum and 26% of the steel, indicating that these tariffs are likely to significantly disrupt supply chains. The ongoing tariff relief efforts are essential to mitigate the impact on domestic industries.

Chinese goods were especially hit hard, as the baseline tariff was raised by an additional 50%, which pushed the baseline tariff up to 104% on April 9, 2025. The same 25% tariff applied to Canadian and Mexican imports, though goods compliant with the USMCA were given a permanent stay. Those temporary elements of the policy are designed to generate leverage in ongoing or future trade negotiations.

Country | Product Category | Tariff Rate |

|---|---|---|

China | All Goods | 104% |

South Africa | All Goods | 31% |

Canada/Mexico | Non-USMCA Goods | 25% |

Global | Aluminum/Steel | 25% |

Global | All Imports | 10% |

Why has the U.S. implemented these tariffs?

The stated goals include reducing the trade deficit, which prompted the 10% emergency tariff, and boosting domestic industries by discouraging reliance on foreign goods. Tariffs can be a very effective and strategic tool to prosecute unfair trade practices. This is most apparent in the recently enacted actions against China and South Africa.

Product-specific tariffs were justified on the basis of national security concerns, especially for products like critical materials, steel, and aluminum. These tariffs are a manifestation of an overall protectionist trade policy agenda, focused on remaking the world’s trade relationships.

How do these tariffs align with broader geopolitical goals?

Together, these measures serve as both a response to unjust trade practices and a strengthening of the U.S.’s hand in negotiations. Commerce tariffs on Chinese goods, for instance, focus on reducing our economy’s harmful reliance on foreign supply chains, while appearing tough with the administration’s trade adversaries.

Retaliation risks are greater than ever. As an example, China has raised its tariffs to 15% for all coals and liquefied natural gas, and a 10% tariff for oil and various machinery. The economic impact of this is massive. The policy’s havoc was further on display by the $6.6 trillion loss in the U.S. Stock market over the course of just two days.

Impact on Key Domestic Industries

The rapid changes created by the new U.S. tariffs policy have made a sizeable impact on many key domestic industries. While the policy aims to bolster American manufacturing and reduce dependence on imports, it has brought challenges like increased costs and supply chain disruptions, particularly in the context of national security interests and the fentanyl crisis. Here’s a deeper look at its impact on advanced manufacturing, ag tech, and precision ag.

Manufacturing sector challenges and opportunities

Tariffs on raw materials, especially steel and aluminum have drastically raised production costs for our manufacturers. Builders in construction, for example, face a 25% tariff on softwood lumber, 70% of which is imported from Canada, and drywall, 30% of which comes from Mexico. This has increased costs, particularly for industries that use a lot of imported materials, like automotive, furniture, and cabinetry.

The new 10% universal tariff, going into effect on April 5, will impose additional price increases on consumers across many industries, including automotive manufacturing and construction. Every challenge is an opportunity for reshoring. Key domestic industries such as metal fabrication and machinery manufacturing would become stronger as domestic production becomes newly competitive.

Long-term reductions in costs and increases in efficiency are needed for that feasibility. Since many developing countries offer cheaper labor, reshoring requires substantial investments in automation and workforce development to compensate.

Effects on the technology industry

The technology sector, which is especially dependent on imported components that include semiconductors, suffers overall supply chain disruptions from tariffs. These disruptions not only cost billions in product launch delays, but increase consumer prices. Companies are looking to diversify supply chains and move procurement to regions with a low-tariff impact.

However, transitions like this take time and capital.

Agricultural sector struggles and adaptations

Retaliatory tariffs applied by other nations in response have made U.S. Farmers less competitive in increasingly important global markets. Increasing prices of fertilizers and machinery only add to the pressure on the sector. Farmers look to find new markets and turn to government assistance.

Real long-term success requires a smarter approach based on sustainable solutions.

Economic Impacts of the New Tariffs

The most recent U.S. tariffs policy has created new dynamics and destructive changes among all economic variables, particularly inflation, worker employment, and consumer spending. These changes are generating an extraordinary threat to economic security and necessitate close examination to understand their implications for national security interests and the future.

How are tariffs influencing inflation rates?

Second, tariffs have contributed to inflation by raising the price of imported products and inputs. The University of Michigan recently reported a spike in inflation expectations, hitting 4.9% for Mar 2025. This increase reflects a dramatic surge in public worry about rising costs.

Likewise, the Federal Open Market Committee adjusted its 2025 inflation forecast as well, expecting rates to be elevated beyond original expectations. By increasing the average effective tariff rate from 10% to more than 23%, these new tariffs have dramatically increased production costs for a range of industries.

This increase is most apparent in industries such as electronics and automotive, which heavily rely on imported components. For a clearer picture:

Sector | Pre-Tariff Inflation Rate | Post-Tariff Inflation Rate |

|---|---|---|

Consumer Electronics | 2.1% | 5.4% |

Automotive | 1.8% | 4.7% |

Food and Beverages | 1.5% | 3.6% |

What is the impact on U.S. job markets?

The labor market shows uneven reactions. Industries under stress from overseas, like sectors of manufacturing that rely heavily on foreign materials, have announced the most layoffs. Among these, the Institute of Supply Management reported the first drop in new orders in four months.

On the other hand, such as by fostering opportunities in domestic production, most notably in states that are investing heavily at home on infrastructure. The uneven distribution of job gains and losses highlights the need for workforce training to address skill gaps, ensuring long-term adaptability.

How are consumer prices being affected?

Consumers are hurt by higher prices on both imported goods and goods produced domestically. For low-income households, this is a huge bite to swallow, as even basics like food and clothes are less affordable.

Changes in behavior like stockpiling in anticipation of price increases impact spending patterns considerably. With real disposable income expected to fall into negative territory by mid-2025, consumer spending will soon turn negative and deepen the economic hurt.

Effects on Global Trade and Supply Chains

The new universal U.S. Tariff policy, which includes a 10% tariff applied uniformly across all imports, addresses the issue of reciprocal tariff actions that target specific countries. Since April 2025, these tariff actions have severely impacted global trade and supply chains, fundamentally changing international economic relationships and redefining how industries train, deploy, and equip their workforces globally.

How are trading partners responding to U.S. tariffs?

China, Canada, and the European Union, important trading partners, are retaliating. In retaliation, they have imposed retaliatory tariffs on U.S. Measures. China has executed a significant 25% tariff on U.S. Agricultural commodities.

Canada and the EU have kept their retaliatory tariffs narrowly targeted on U.S. Steel, aluminum, and automotive component imports. These moves have reduced the need for U.S. Exports. This is particularly acute in agricultural and manufactured goods, for which global markets are essential to their bottom line.

Despite continuing diplomatic negotiations, no tangible and meaningful resolution has been reached, requiring businesses to operate amid a volatile trade environment.

Country | Product Category | Retaliatory Tariff Rate |

|---|---|---|

China | Agricultural goods | 125% |

Canada | Steel and aluminum | 25% |

European Union | Automotive parts | 20% |

Long-term implications for global supply chains

The current tariff anxiety is accelerating the move toward regionalized supply chains and more local production. In fact, firms in the car industry today consider production centers nearer to final markets to save on expenses.

Technology—especially AI-driven logistics—is similarly emerging as a key player in navigating disruptions. Firms are therefore scrambling to find stable platforms where unpredictable tariff policies have less of an impact.

Consequently, there will be lasting changes and reorientations of routes and trade networks.

Shifts in international trade dynamics

China and India are establishing their own trading blocks and the U.S. Will be excluded. They are deepening their connections with Europe and Africa.

This shift could mean the beginning of the end of U.S. Dominance over the rules of global trade. Nations are more fiercely than ever competing to attract foreign capital.

They achieve this through providing tariff-free economic zones and incentives, along with the counterweight of emerging economies more and more driving global trade patterns.

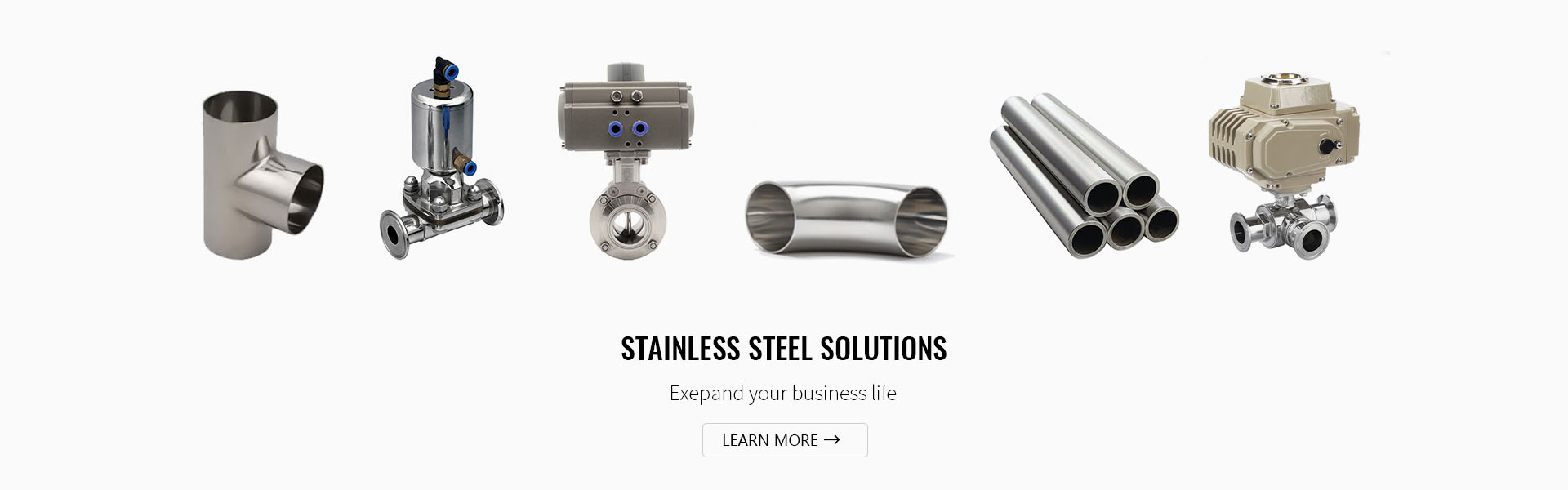

Tariff-Specific Analysis: Stainless Steel Seamless Tubing from China

Understanding the implications of U.S. tariff policies on stainless steel seamless tubing requires a focused look at the current rates, regulatory complexities, and business adaptations, particularly in light of the increased tariffs and trade barriers affecting foreign trading partners. Together, each of these facets sheds light on how this important but often overlooked sector is weathering the ever-changing trade storm.

Current tariff rates for stainless steel seamless tubing

Today, the U.S. Has tariffs of 25 percent on stainless steel seamless tubing imported from China imposed outwardly under Section 232 and anti-dumping tariffs. These rates include the base Trump tariffs of 25% for steel products.

In addition, they impose supplemental duties that vary according to the results of anti-dumping investigations. For example, the last few determinations have listed dumping margins of anywhere from 48% to 106%. These types of tariffs are intended to level the playing field for American manufacturers by dealing with predatory pricing practices and overcapacity issues.

As a result, these rates can greatly inflate costs for U.S. Companies. Those who depend on imported tubing for construction, automotive, and energy applications will be hit the hardest. As an illustration, a U.S. Energy company that buys 2-inch seamless tubing could be hit with a 131% total tariff on its imported product.

Regulatory challenges for importing from China

So, importing stainless steel seamless tubing from China is a little like running a steeplechase. The only thing that goes into that process is compliance with U.S. Customs and Border Protection (CBP) requirements, ADD Orders, and periodic audits.

Serious challenges come from confusing and often excessive requirements for documenting compliance with the detailed requirements, such as certificates of origin and mill test reports. Variable rule enforcement can lead to increased timeframes and surprise expenditures.

That is why it is important for importers to maintain detailed documentation, and that they get out in front on issues with customs officials.

How businesses in this sector are adapting

To combat increased costs, companies around the country are urgently working to broaden their supply chain. They have since moved sourcing to countries with lower tariffs, like India and South Korea.

Some are even investing in domestic production capabilities to eliminate the need for imports entirely. Many companies are taking proactive steps in designing smarter inventory processes to hedge against volatility in supply and price.

For an industrial tubing manufacturer, it could make sense to stockpile these critical materials when they are cheaper on the market. This strategy allows them to lessen the shock of future tariff rate increases.

Strategies for Businesses to Navigate Tariff Challenges

The unpredictable, ever-changing U.S. tariffs policy has completely upended trade relations, prompting businesses to adopt proactive strategies to mitigate the impact of tariff actions. Understanding these measures is crucial for maintaining operational stability and fiscal health amid the challenges posed by increased tariffs.

Diversifying supply chains to reduce dependency

Diversifying supply chains is a main strategy employed to mitigate risks. Second, it smartly reduces patterns of concentrated dependence on one country or source. For instance, over 70% of softwood lumber used in U.S. Construction is imported, making it highly susceptible to tariff-induced price increases.

Companies can often mitigate risk by sourcing lumber and other raw materials from multiple foreign and domestic suppliers. This approach allows them to mitigate risk and weather storms.

Businesses impacted by semiconductor shortages as a result of low domestic production are looking to other suppliers or are making moves to reshore production. Such adjustments often require detailed analysis of logistics, cost implications, and supplier reliability, ensuring supply chain resilience even amidst fluctuating trade policies.

Negotiating with suppliers for cost-sharing solutions

By working closely with your suppliers to share the pain associated with rising costs, you could go a long way toward realizing financial relief. For instance, companies can seek longer payment terms or volume discounts to balance out the costs from the tariffs.

Some are front-loading inventory—importing additional materials before tariffs rise—which adds significant strain on cash flow. Cost-sharing agreements allow diverse sectors and organizations to share the financial burden equitably, relieving some of these pressures.

Frequent, open communication and a proactive relationship with suppliers will ensure both sides are working toward the most beneficial outcomes possible.

Leveraging government support and trade programs

Businesses are leveraging government resources, such as tariff exemptions, export assistance, or subsidies, to offset the millions of additional costs they’re facing. Ongoing federal initiatives to support the long-term domestic production of key materials, especially in technology and mass timber, offer enduring remedies.

Businesses currently freezing new purchases and relying on existing inventory should pay close attention to developing policy for opportunities to turn these supports to their advantage.

Finding Reliable Suppliers Amid Tariff Uncertainty

The most recent U.S. tariffs policy has made things even more difficult for businesses, especially for those who are most dependent on global supply chains. To navigate these conditions, companies should adopt a risk-based approach that balances responding to short-term needs while mitigating longer-term risks related to tariff actions.

Identifying Alternative Suppliers Outside High-Tariff Regions

Given that 65% of companies have already started the search for alternative suppliers, finding suppliers from outside the areas with high tariffs has quickly become an essential first step.

Diversifying the supplier base to focus more on countries with beneficial trade agreements can help companies avoid the shock of increasing costs. For example, many companies have moved production to Mexico or Southeast Asia, where regulatory and tariff barriers are not as prohibitive.

One great case in point is the manufacturer that proactively set up an additional manufacturing plant in Mexico, greatly reducing their reliance on Chinese imports. As a result, this strategic move protected against tariff risks and reduced lead times.

Evaluating Supplier Reliability and Cost-Effectiveness

Building a network of dependable suppliers goes beyond the bottom line. Companies need to determine the level of quality standards, compliance with industry safety standards and historical performance.

Leveraging Occupational Health and Safety Administration data can help identify potential risks, such as preventable forklift-related incidents, ensuring workplace safety. To mitigate these risks, businesses must use demand forecasting tools and historical data to ensure supplier capabilities match inventory needs.

This approach optimizes efficiency and cost-effectiveness through the supply chain.

Building Long-Term Partnerships to Mitigate Risks

Building strong partnerships with essential suppliers creates a foundation of support during times of policy uncertainty. On the supplier side, long-term agreements offer more predictable pricing and priority access to resources during disruptions.

Even for reshoring operations, which offer a rosy outlook, is still an arduous process that takes years of strategizing and implementation. Companies should explore flexible contracts and joint ventures to balance cost and adaptability.

Broader Implications for U.S. Competitiveness

This newest chapter of U.S. tariffs policy has far-reaching implications for America’s competitive place in the global economy. By examining key areas such as industry competitiveness, long-term economic impacts, and national security interests, particularly concerning the fentanyl crisis, we can better understand these effects.

How tariffs affect the global competitiveness of U.S. industries

Tariffs immediately increase the cost for all manufacturers that depend on imported parts, materials, and equipment, significantly impacting the final products’ pricing. For example, in key sectors such as microelectronics and bio-manufacturing, the United States is highly dependent on global supply chains, which makes it challenging to compete with countries capable of producing goods at lower costs. This scenario underscores the importance of a robust tariffs policy to protect national security interests and economic security.

Excessive and disparate tariff rates, along with non-tariff barriers, further restrict U.S. manufacturers’ and workers’ access to foreign markets. Addressing these trade barriers is crucial, as it can serve as a vital tool in reversing the decline of our manufacturing base and mitigating job losses.

Predictions on long-term economic outcomes

The long-term economic impact is costly. Tariffs represent a diminished capacity to both withstand supply chain shocks, born of a lack of domestic manufacturing capacity in critical industries, such as battery production. Mounting trade deficits, in conjunction with a 1.7 to 2.1 percent hike in consumer prices, weigh heavily on American companies and families alike.

Furthermore, the decline in manufacturing jobs has broader societal effects, such as lower family formation rates and heightened social issues, like opioid abuse, which strain the economy.

Balancing national security with economic growth

In short, building a strong domestic manufacturing base in defense-critical areas, such as advanced equipment production, is vital for safeguarding national interests. Investments in key technologies such as bio-manufacturing and microelectronics will secure our homeland as well as our place in the global economy.

Finding the right balance among these priorities will help foster more robust economic growth while protecting our national defense.

Expert Opinions and Predictions on Tariff Policy

The recent U.S. tariff policies, particularly the increased tariffs, have prompted significant analysis, hand-wringing, and finger-pointing by economists, industry leaders, and policymakers. These opinions provide a rare glimpse into the impact of these tariff actions and the adaptations needed to ensure economic security while navigating this new trade landscape.

Insights from Economists on Future Tariff Trends

Most economists agree that tariff policies generally raise the cost of production, hurt consumers with higher prices, and thus contribute to inflationary pressures. In fact, many believe these measures could actually reduce economic growth.

Just last week, for example, Sen. Rand Paul said that the idea that tariffs are somehow good for our country is a delusion. Warren Buffett has called tariffs “an act of war, to some extent,” emphasizing their economy-wrecking capacity.

To wit, key economic barometers like the 10-year Treasury yield have been with extreme volatility, mirroring market jitters. Despite setbacks globally and domestically, the unemployment rate remains at a historic low as evidence of American resilience.

The latest jobs numbers have blown past predictions, reflecting an uneven economy.

Perspectives from Industry Leaders on Adapting to Changes

Industry leaders underlined the need for increased flexibility to address changes in tariffs. Callie Cox of Ritholtz Wealth Management called out the importance of recognizing the unpredictability of policy reaction and market reaction.

She urged businesses to focus on resilience, not speculation. Meanwhile, homegrown firms that depend on imports from the EU suddenly have a very damaging 20% tariff.

In the meantime, importers from countries such as Vietnam and Japan face higher rates, sometimes triple. These changes have required tactical supply chain realignment and market price control to reduce exposure.

Predictions on Potential Policy Shifts Under New Administrations

Future administrations will have to reconsider today’s tariffs policy, not least of which because they’ve been decried by critics as the biggest peacetime tax increase. Advisors have warned of the global financial risks tied to aggressive tariff actions, implying potential for policy recalibration to balance economic security and trade objectives.

Conclusion

Like any seismic shift in policy, the new U.S. Tariff landscape poses major challenges, but also major opportunities. While every industry is impacted by increased costs, they simultaneously have opportunities to innovate and adapt. Such changes encourage firms, especially micro, small, and medium-sized enterprises, to adapt new approaches, strengthen regional networks, and navigate toward new markets. Whatever the situation, staying informed and proactive will enable companies to better address these various uncertainties.

For stainless steel seamless tubing, the tariffs brought home the lesson that courting multiple suppliers and controlling costs will be critical to success. Here’s how every business can bolster their competitive advantage by doubling down on efficiency and smart sourcing.

Trade policies are ever-changing, no doubt, that’s exactly why resilience and adaptability are most important. With careful planning and strategic positioning, companies can deliver to manipulate these places and seek out new growth. Adopt an attitude of continuous learning, be willing to adapt, and never lose sight of the long game.

Frequently Asked Questions

What is the latest U.S. tariff policy about?

The effective U.S. tariffs policy changes take tariff action against certain unfair imports, such as President Trump’s new dumping duties on stainless steel seamless tubing from China. This action aims to protect U.S. industries from foreign trade barriers and ensure economic security.

How do the new tariffs affect U.S. businesses?

In turn, the increased tariffs raise costs on firms that depend on imported intermediate goods. For firms in cost-sensitive industries, such as manufacturing or construction, these tariff actions can significantly affect their prices and profits.

Which industries are most impacted by the new tariffs?

Steel, manufacturing, automotive, and construction are just some of the important industries that are negatively impacted by increased tariffs. Businesses in these sectors will be grappling with immediate and detrimental supply chain disruptions and rising material costs due to tariff actions.

How will the tariffs influence global trade?

The new tariffs policy could damage existing U.S. trade relationships and disrupt established global supply chains. Countries affected by these tariff actions may retaliate, creating uncertainty for businesses engaged in international trade.

What can businesses do to navigate tariff challenges?

Businesses can take proactive steps to minimize rising costs through diversification of suppliers, exploration of domestic options, and renegotiation of multi-year contracts. Working with trade experts can further reduce risks related to tariff actions and help your company stay compliant.

How do tariffs impact U.S. competitiveness?

Additionally, higher tariffs, as part of the tariffs policy, can push up the production costs for U.S. goods, making them less competitive on a global scale and limiting U.S. exporters’ opportunities abroad.

Are there any exceptions to the new tariffs?

Of course, exemptions can be granted in specific situations. Businesses can apply for tariff relief through the government’s Exclusions Portal if they can prove that their product meets certain criteria.